According to an industry report, India's housing market continued to rise steadily in the second quarter of 2024, with average prices in the top eight cities rising by 3% quarter on quarter (QoQ). The general trend of 3% quarterly price rise has continued for the previous four quarters, showing continuous demand, according to a report released by the Confederation of Real Estate Developers and Associations of India (CREDAI) and property consultancy companies Lisas Foras and Colliers.

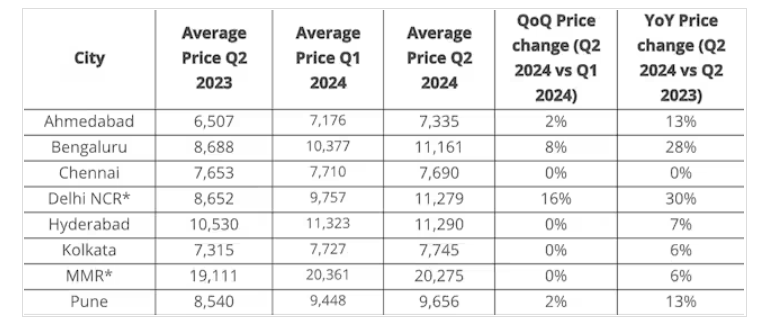

On a yearly basis, average home costs in the eight main cities increased by 12%, with Delhi NCR topping at 30%.

Pan-India home pricing trends (Q2 2024) (in INR/sq ft):

All costs are based on carpet area

*NCR refers to the National Capital Region

**MMR stands for Mumbai Metropolitan Region

"Despite price increases, sales in India's cities have continued to expand. The current quarter also saw an impressive 33% growth in new releases in the inexpensive class. NCR's increased sales and new product releases indicate that the market will continue to develop," said Pankaj Kapoor, Managing Director, Liases Foras.

Leading the top eight cities, Delhi NCR had a 16% QoQ increase in house costs. At 16%, average house prices in Delhi NCR had the most quarterly price increase. Within Delhi NCR, Dwarka Expressway and Greater Noida had significant price increases of 35% and 24% QoQ in average property prices, respectively. This is the greatest quarterly price increase for these micromarkets in recent quarters, driven by an increase in luxury sector debuts.

Furthermore, the desire for big housing units in the luxury and ultra-luxury classes resulted in a 12% QoQ increase in the average price of 3-4 BHK configurations in Delhi NCR. Bengaluru too saw considerable price increases, with average home costs in the city exceeding Rs 11,000 in Q2 2024. The city's average home prices rose by 8% quarterly. Within Bengaluru, the Inner East micromarket saw the greatest quarterly increase at 25%, followed by the Periphery Outer East micromarket at 10%.

"In the residential market, demand growth has been highest in the premium and ultra-luxury sectors, including second and vacation homes, as seen by price increases in certain micro-markets in Delhi NCR and Bengaluru. Average housing costs for big dwelling units, particularly 3-4BHK configurations, in these cities have risen by up to 30% every year. Furthermore, the government's recent partial rollback of long-term capital gains arising from the retrospective sale of land and buildings is expected to boost investor and homeowner sentiment, and thus the real estate sector as a whole," said Vimal Nadar, Senior Director and Head of Research at Colliers India.

The Mumbai Metropolitan Region (MMR) continues to lead the market, accounting for over 40% of unsold inventory. Excluding MMR, unsold inventory levels have decreased by up to 5% quarterly across all cities under consideration. While MMR saw strong residential unit sales in Q2 2024, a huge jump in new releases resulted in a small increase in unsold units.

Pune had the biggest yearly fall in unsold apartments (13% YoY). Unsold inventory levels have fallen by 6-8% year on year in Ahmedabad, Chennai, and Kolkata.

Kolkata saw the largest sequential fall in unsold inventory levels, at 5%, followed by Pune, which fell 3%. As of Q2 2024, there were more than 10 lakh housing units available in the core markets of eight major cities, with MMR accounting for almost 40% of unsold inventory. Despite a year-over-year increase in the number of unsold units in Hyderabad and Bengaluru, both cities experienced a little decrease in consecutive sales.