We design real estate strategies that align with how our clients want to build wealth over time. Every investment we bring is structured with discipline, transparency, and a clear roadmap from entry to exit

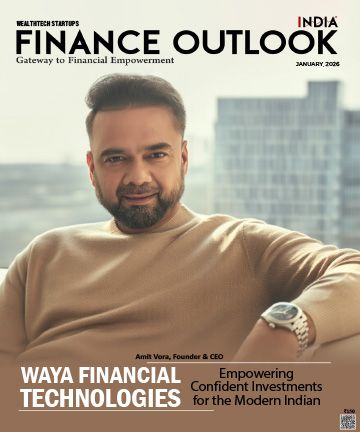

Pranay Reddy, Founder

Pranay Reddy, Founder, Alt Investments

India’s wealth and real estate investment landscape is expanding rapidly, but for investors, growth has come with complexity. The contemporary market is flooded with products, mixed advice, and a flood of information that is not always clear. Given this, investors encounter pressing challenges with riskadjusted returns, liquidity and exit, tax planning, and identification of real opportunities and speculative hype. The old-fashioned advisory models, with their generic portfolios and transactional selling, find it difficult to cope with the expectations of a new generation of investors that seek transparency, customization, and a disciplined approach to longterm planning.

Alt Investments addresses these challenges by offering a disciplined, institution-grade approach to real estate investing. The company was established by Pranay Reddy, wherein, the firm is steadfast to providing HNIs, UHNIs, institutional, and family office clients with institutional-level opportunities. The firm uses strict due diligence, empirical underwriting, and well-defined governance to assist customers in investing with confidence. Through the provision of curated real estate portfolios, defined exit solutions, transparent reporting, and lifecycle management, the firm simplifies complex decisions to invest and ensures that each opportunity fits the financial objectives of a client.

Building Institutional-Grade Real Estate Wealth Solutions

Alt Investments is a company that functions in the nexus of real estate, disciplined capital allocation, and long-term wealth creation. The firm is purely dedicated to private real estate investments with curated opportunities, which previously could only be accessed by private equity funds, big institutions, and family offices.

The center of the service model of Alt Investments is the availability of diversified asset classes in property. These consist of asset reconstruction deals involving distressed or underpriced property and Grade-A office space, including blue-chip tenants. Other portfolio areas include warehousing and industrial parks that suit the growth of logistics and e-commerce in India, as well as residential property built-to-rent with recurring rental revenue. Besides this, it touches on hospitality and resort investment aimed at maximising yields, and high-end residential villas in line with long-term value growth. Every asset category focuses on specific investor objectives, and portfolios can be built to focus on income, capital growth, or both.

The majority of the opportunities created by the company are presented in the form of Special Purpose Vehicles (SPVs), which provide institutionquality governance, well-defined cash-flow waterfalls, and exit mechanisms upfront. Its products consist of organized equity investment, co-development and joint cooperation with pre-eminent developers, value-added and distressed property purchases, and pre-leased rental-yield properties that give foreseeable rewards.

The unique aspect of the company is its end-toend lifecycle management. The company handles all stages of the deal sourcing and underwriting process, asset management, compliance, reporting and exits. Investors are provided with comprehensive reporting, performance analytics, as well as frequent updates, which establish the level of transparency that is almost non-existent in the case of private real estate investing.

“Our focus has never been on selling properties. We design real estate strategies that align with how our clients want to build wealth over time. Every investment we bring is structured with discipline, transparency, and a clear roadmap from entry to exit,” highlights Founder and CEO Pranay Reddy.

Expanding Geographies & Preserving Discipline

Under the leadership of Founder and CEO Pranay Reddy, the firm has carved out a distinct position by bringing institution-grade real estate opportunities to high-net-worth individuals, family offices, and global investors seeking long-term, risk-adjusted returns. Alt Investments was founded on a clear conviction: real estate can be one of the most powerful engines of wealth creation when approached with strategy, governance, and deep market intelligence.

One of the key points in the journey of the firm has been the focus on transparency and life cycle management. Under SPV governance and institutional compliance standards, investors have obvious transparency of structures, cash flows, documentation, and exit strategies. This has resulted in high client retention, reallocation, and development through a combination of organic growth and a large portion of referrals.

Looking Ahead, Alt Investments is mapping a path towards growth without compromising values. The company intends to open up international property markets, allowing customers to diversify in geographies and currencies. The technology will be at the centre stage, and it will develop a digital platform that provides real-time reporting, analytics on portfolio tracking, and performance.

The firm is also planning to expand participation models and launch other products like AIFs, REITs, PMS, and integrated solutions of the real-asset investing ecosystem. With this development, the company will continue to be guided by its core purpose, which is to offer structured, transparent, and performance-based real estate investments to enable investors to create long-term, future-proof wealth.