Motilal Oswal Financial Services highlights a strengthening trend across base metals — Copper, Zinc, and Aluminium — as tightening inventories, sustained electrification demand, and supply-side constraints continue to reshape the commodity landscape.

Copper

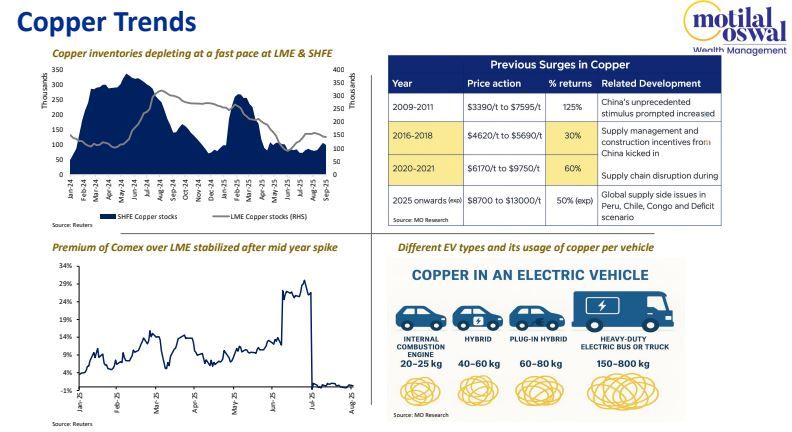

Domestic copper is trading ~27% higher YTD, triggered by US announcing tariffs on copper imports sending shockwaves through global markets and surge in demand from risingEV sales, electrification usage in AI and global energy transition

• Prices recently touched an almost two-year high, above $10300 supported by a pressured dollar, lower inventories, supply disruptions from key mines, and narrower surplus figures from ICSG

• Inventories on SHFE and LME, have halved since the start of the year, from ~200,000 t to 98000 t and ~300,000 t to 143000 t respectively

• Electrification of transport and infrastructure is a key driver, with EV’s requiring between 25-50 kgs of copper per unit, compared to just 8–12 kgs in conventional vehicles and demand for EVs are expected to double up to 2.2MT by 2030, compared to 1.2MT in 2025

• Electrification of transport and infrastructure is a key driver, with EV’s requiring between 25-50 kgs of copper per unit, compared to just 8–12 kgs in conventional vehicles and demand for EVs are expected to double up to 2.2MT by 2030, compared to 1.2MT in 2025

• Accidents and disruptions at major mines have been the critical drivers of prices recently, following accident at El Teniente in Chile, Grasberg mine in Indonesia and protests at Constancia mine in Peru which could add to the already tight supply situation

• Grasberg accounted for 3-4% of total mined copper supply, producing ~1.5MT of concentrate last year

• China exported over 460,000 t of ref. copper in the first eight months of 2025, up by 15% YoY largely to the US, capitalizing on the  Arb opportunity

Arb opportunity

• China’s imports of refined copper increased ~8% YoY to nearly 335,000 t in August

• ICSG showed copper market posted a surplus of 101k tons in 2025 so far, way narrower than 401k tons surplus in the same period last year

• They also expect a deficit of 150000 tons in 2026, lower than the previously forecasted oversupply of 209000 tons

• The long-term outlook for copper remains strongly bullish, supported by structural shifts in the global economy toward decarbonization, electrification, and digitalization along with persistent risks of disruption.

Zinc

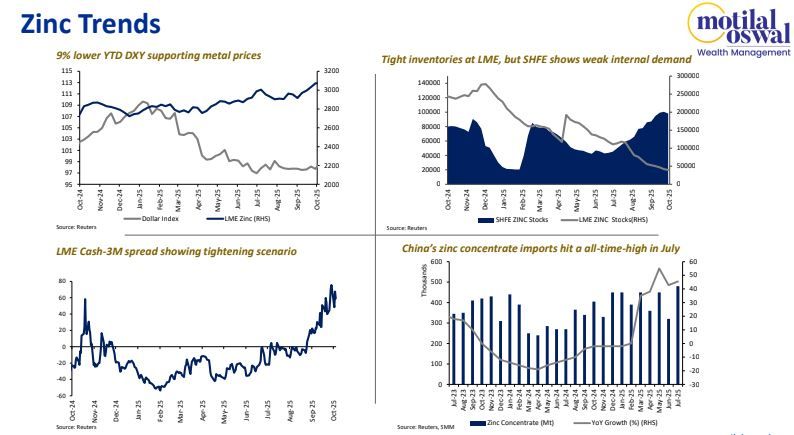

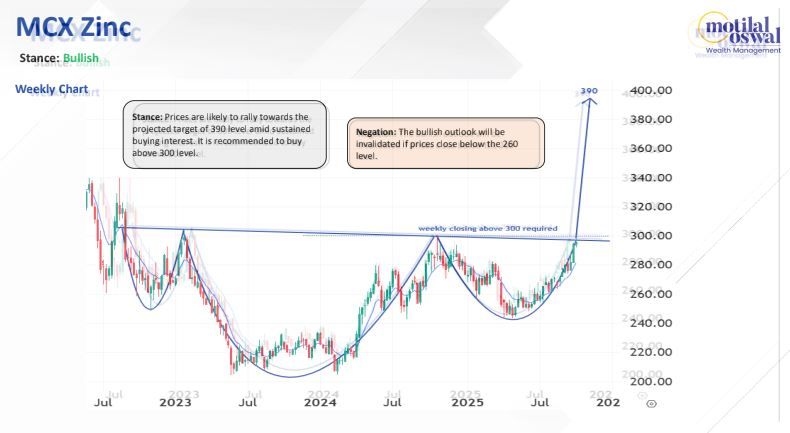

• Zinc prices on LME rose above $3000/tonne in September 2025, posting a ~9% rally YTD, supported by depleting inventories and weaker US dollar

• Zinc prices on LME rose above $3000/tonne in September 2025, posting a ~9% rally YTD, supported by depleting inventories and weaker US dollar

• Weaker US dollar and expectations of Chinese production cuts further boosted sentiments, even though broader demand trends remained uneven

• LME zinc stocks dropped sharply below 50,000 tons, with large withdrawals led by traders like Trafigura, shifting some supplies to the US

• LME Cash-3M flared out to $60 per metric ton, a level last exceeded in 2022, suggesting acute supply deficit

• Chinese smelters have been ramping up production since Q2 as treatment charges rise amid improved raw material availability, with the country’s imports of zinc concentrates surging 43% YoY over January–August 2025

• Peru’s zinc ore exports grew modestly by 4.5% in early 2025, supported by increased output at major mines such as Antamina and Cerro Lindo

• India’s zinc imports rose 23% YoY in H1 2025, driven by construction, railways, power transmission and infrastructure demand

• Refined production fell by 2.1%, owing to lower smelter output in Brazil, Kazakhstan and in Japan due to the closure of Toho Zinc’s Annaka plant

• ILZSG estimated a global surplus of 72,000 tons till July 2025, still tighter than the 185,000 MT surplus a year earlier

• Global refined zinc production has held steady, though Chinese smelters are facing pressure from overcapacity and weather disruptions

• A planned shutdown of Nyrstar’s Clarksville smelter in the US this October–November is expected to tighten supply further

• Zinc prices remain supported by maintenance of smelters, continuous depleting inventories rising Chinese demand and a volatile dollar.

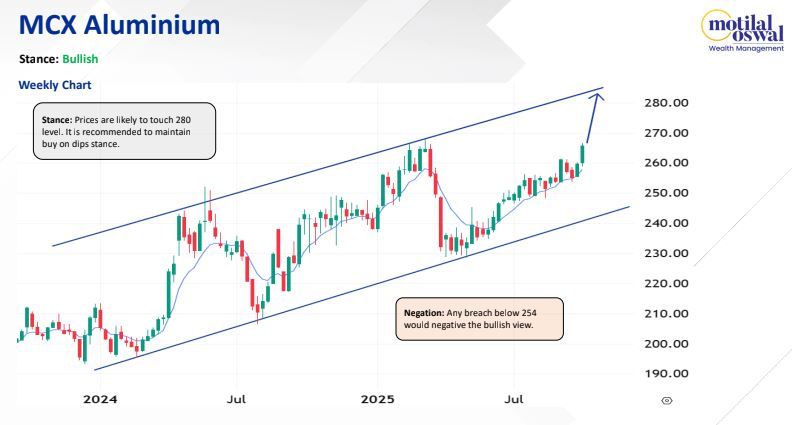

Aluminium

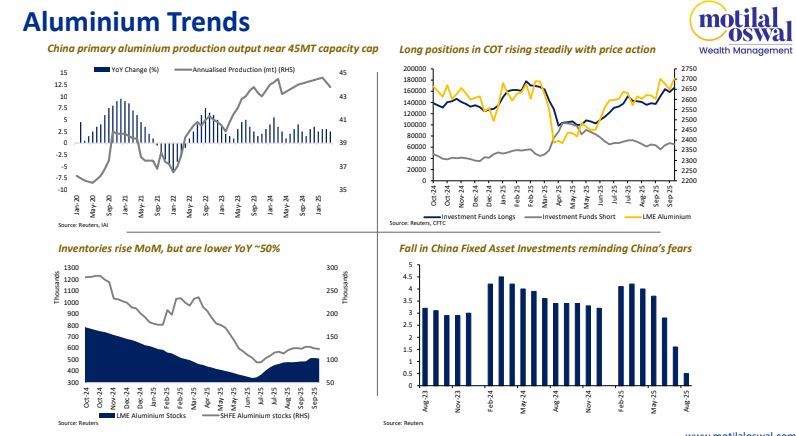

• Aluminium prices on LME reached a six-month high above $2700, largely fueled by optimism over the US Federal Reserve’s 50-bps rate cut lifting overall commodity prices and China reaching its production cap of 45 MT

• Aluminium prices on LME reached a six-month high above $2700, largely fueled by optimism over the US Federal Reserve’s 50-bps rate cut lifting overall commodity prices and China reaching its production cap of 45 MT

• LME aluminium inventories are 50% lower from highs seen in June 2024, and SHFE are ~53% lower

• China’s aluminium imports surged 40% YoY to 317549 t in 2025, supported by higher inflows from Russia, Indonesia, and India

• In contrast, US aluminium imports slumped 35% to 212355 t in the same period, due to lower shipments from Canada, the UAE, and Bahrain

• US expanded its 50% tariff regime on steel and aluminium imports to include hundreds of derivative products weighing on demand prospects

• China produced about 22 MT of primary aluminium in H1 2025 marking a ~2.5 % YoY increase

• Annualized production averaged 44 MT over H1 2025, just a MT short of the 45 MT cap, which was set in 2017

• Indonesia emerged as focal point for new aluminium production capacity, driven by Chinese companies investing in offshore smelting operations

• They are projected to add between 2.3 and 7 MT of capacity by 2030 with a few hiccups due to resource allocation

• Chinese authorities cut their annual output growth target for metals to an average of 1.5% annually for 2025 and 2026, compared to the 5% target previously given

• China Industrial production dipped to 5.2%, Fixed Asset Investments rose only 0.5% YoY - still showing lag in Chinese economy

• Some optimism amongst metals may support aluminium, although a mix of fundamentals, may keep prices hovering within a range.

Source : Press Release