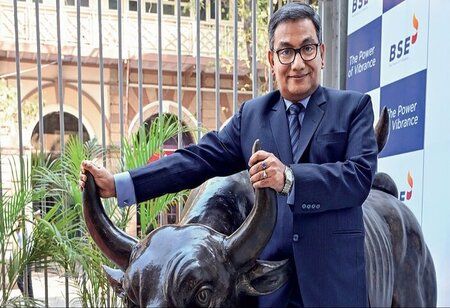

Sundararaman Ramamurthy, BSE Managing Director and CEO, stressed the importance of investor awareness and responsibility on Thursday, saying that regulations alone cannot protect investors if they do not take adequate precautions when investing.

"You trade what you understand, and you understand what you trade. If you don't do that, you have a problem," Ramamurthy said, urging investors to be vigilant and informed.

He criticized investors for relying on hearsay rather than conducting due diligence.

"You scan a vegetable before you buy it, but when you invest your life's earnings, you go by hearsay that's not how it should be," according to him.

Regarding regulatory expectations, the BSE chief stated that there is a widespread belief that regulators are blamed when investors lose money, but when markets perform well, the same person praises their own knowledge.

"If you don't want to protect yourself, no amount of regulation will help you. "Be alert," he advised.

Addressing the issue of retail participation at the Calcutta Chamber of Commerce, Ramamurthy advised small investors who are not market experts to use mutual funds, but even then, they should avoid thematic funds in favor of broad-based mutual funds or large-cap funds to diversify risk.

He also encouraged women and youth to start investing early in their careers.

The BSE CEO highlighted the potential of India's SME sector, pointing out that only about 40 companies from this region are currently listed on the stock exchange, despite the fact that the actual potential is much higher. He urged more small and medium-sized businesses to consider listing as a viable option for raising funds, expanding their operations, and realizing their full potential.

Responding to a question about possible manipulation in SME listings, Ramamurthy admitted that frauds like pump-and-dump schemes could not be completely eliminated even if regulators and stock exchanges were vigilant.

He stated that BSE was testing AI and large language models for initial scanning of IPO documents to identify areas of concern.

He reiterated the importance of investors understanding the businesses in which they invest and conducting proper due diligence.