New Delhi, India – The National Payments Corporation of India's (NPCI) RuPay credit card can now be used to conduct peer-to-merchant payments using the Unified Payments Interface (UPI). The Reserve Bank of India certified this interoperability to promote digital payments in September 2023.

Daily Limit on Rupay Credit Cards

The daily maximum for these transactions is Rs 1 lakh, with merchant category codes allowing for up to Rs 2 lakh. The National Payments Card Institute (NPCI) explains, "However, it will be limited to the available credit limit on your card."

Rupay Credit Cards: Transaction Fees and Other Fees

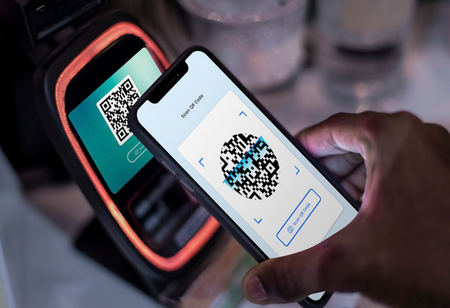

Payments made using credit cards over UPI are free of charge. Credit card payments using UPI can also be done by scanning a QR code. (Also Read: PPF: Rs 12,500 Monthly Investment Will Provide Rs 2.27 CRORE Return Over These Many Years)

How Do I Pay With My Rupay Credit Card?

There are numerous platforms available that allow you to effortlessly Credit cards can be used on UPI through apps like as PhonePe, Google Pay, Paytm, BHIM, BHIM PNB, CRED, CanaraA1, Gokiwi, PayZapp, Slice, and Mobikwi.

Which banks accept credit cards via UPI?

Punjab National Bank, Union Bank, Indian Bank, HDFC Bank, Canara Bank, Axis Bank, Kotak Mahindra Bank, and BFSL are among the banks that accept credit cards via UPI.