The mutual fund industry’s Assets Under Management (AUM) stood at ₹80.23 lakh crore as of December 2025, reflecting steady momentum in investor participation and an increased preference for market-linked investment avenues. This highlights the structural shift in household savings towards financial assets, aided by SIP flows, greater digital accessibility and rising awareness of mutual funds as a core investment vehicle. December recorded SIP inflows of ₹31k crore.

Mutual Fund Industry has grown greater over 6x in the last 10 years:

The industry has expanded over 6x in the last decade, with AUM growing from ₹12 lakh crore in 2015 to over ₹80 lakh crore in 2025. This growth has been supported by broader participation across retail and institutional segments , regulatory developments and increased penetration of digital distribution platforms. The ongoing financialization of household savings has remained an important factor contributing to the industry’s expansion.

Where the Money Flows Report – Quarter ended December 2025:

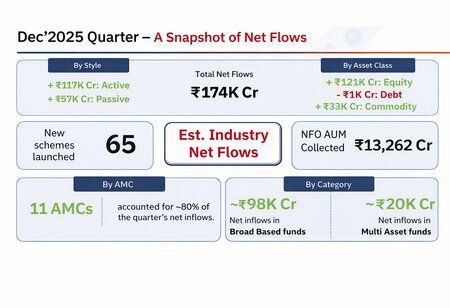

Understanding investor flows offers insight into allocation trends. The latest edition of the Where the Money Flows report examines how capital has been allocated across mutual fund categories for the quarter ending December 2025. The study, leveraging a proprietary 5-tier classification framework, dissects estimated net flows across asset classes—equity, debt, hybrid, commodities and international—while also highlighting the distinction between active and passive strategies. The report provides a comprehensive perspective on allocation patterns during the period..In the December 2025 quarter, the mutual fund industry recorded estimated net inflows of ₹1.92 lakh crore.. Active funds accounted for ₹1.17 lakh crore, while passive strategies accounted for ₹75,000 crore inflows. Equity funds remained a significant contributor, recording net inflows of ₹1.12 lakh crore. Within equities, broad-based funds capturing 88% of active flows and ₹98,000 crores in inflows, underscoring the investor tilt towards diversified strategies. Large-Cap Passive Funds, Flexicap Active Funds and arbitrage strategies accounted for a significant share of flows during the quarter.

Key snapshot: Source (AMFI, BSE, NSE)

Debt funds witnessed marginal outflows during the quarter, recording ₹1,000 crore in net outflows, reflecting investor caution amid ongoing rate uncertainty. However, within this challenging environment, Constant maturity Funds contributed ₹3,100 crores in net inflows, while Liquid Funds saw inflows of ₹27,000 crores, largely for short-term needs. Corporate Bond Funds also attracted inflows, supported by institutional participation, while Target Maturity Funds and Gilt Funds experienced outflows of ₹3,200 crores and ₹2,000 crores respectively, reflecting allocation shifts during the period.

Thematic mutual funds experienced net outflows during the quarter, with passive PSU funds leading the decline by ₹6,300 crores. Manufacturing and Infrastructure sectors together recorded ₹3,000 crores in outflows. However, certain theme such as Defence, Business Cycle and Consumption continued to attract interest, collectively drawing approximately ₹2,000 crores in net inflows. The Defence theme alone garnered ₹1,000 crores during the quarter.

Commodity funds witnessed net inflows of ₹33,000 crores, representing a sharp 56% quarter-on-quarter increase, reflecting sustained investor interest in diversifying portfolios through hard assets for inflation hedging and portfolio diversification purpose.

In the hybrid category, Multi Asset Funds continued to attract robust flows, accounting for 70% of the net inflows within the segment with ₹20,000 crores. Balanced Advantage Funds and Aggressive Hybrid Funds also contributed with ₹3,100 crore and ₹3,900 crore in inflows, respectively.

Also Read: Mutual Fund AUM Crosses Rs 81 Lakh Crore in January: AMFI Data

Passive Funds Snapshot – December 2025:

Passive funds continued to grow, accounting for approximately 18% of the mutual fund industry’s market share. Within equities, passive Large Cap accounted for a significant portion of the category flows. Debt passives registered steady but moderate growth during the period. Commodity-based ETFs recorded net inflows of approximately ₹33,000 crore in net inflows this quarter.

Conclusion:

The December 2025 quarter highlights a multi-asset investor approach, with significant flows into equities, commodities and diversified strategies. While equity retained investor favour through broad-based and systematic approaches, the commodity segment’s resurgence reflects investor demand for inflation hedge and portfolio diversification. Passive investing continues to gain ground steadily, with passive funds accounting for 23% of equity flows, but active strategies remain central to investor portfolios. Overall, investor behaviour points towards preference for broad-based and diversified exposure, aligned with structural growth themes and evolving macroeconomic conditions. The mutual fund industry’s continued growth trajectory underscores its role as the preferred avenue for long-term structured wealth creation in India.

Source : Press Release