Edtech unicorn Before submitting its Draft Red Herring Prospectus (DRHP) to the Securities and Exchange Board of India (SEBI), PhysicsWallah has chosen three independent directors to guarantee adherence to the independence criteria of the Companies Act.

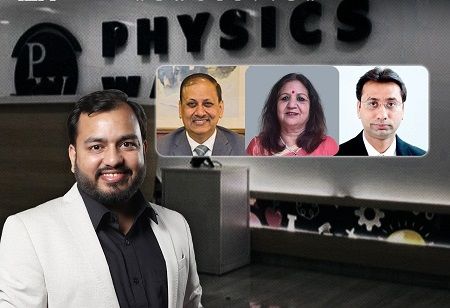

According to its regulatory filing, PhysicsWallah's board has approved a special resolution designating Nitin Savara, Rachna Dikshit, and Deepak Amitabh as non-executive independent directors.

According to a separate filing, the board also appointed Alakh Pandey as the Chief Executive Officer (CEO) and re-designated Prateek Boob and Alakh Pandey from executive directors to full-time directors.

PhysicsWallah has distributed bonus shares to all of its shareholders at a 1:35 ratio prior to its public listing, which means that for each equity share that a shareholder has, they will receive 35 bonus shares.

In December of last year, the company had previously accepted a resolution to change its name from PhysicsWallah Private Limited to PhysicsWallah Limited and become a public corporation. One month has passed since Amit Sachdeva was named the company's new Chief Financial Officer (CFO).

According to reports, PhysicsWallah has hired investment bankers for its impending IPO. It is probably going to be the first unicorn in the edtech space to list on a stock exchange.

The nine-year-old PhysicsWallah has grown into a comprehensive edtech platform that provides study guides, test series, live and recorded lectures, and offline hybrid centers. The company was valued at over $2.8 billion and has raised about $300 million so far.