Inspired by the success of digital financial services, the Reserve Bank of India will create the Unified Lending Interface (ULI), a platform to ensure the smooth flow of credit, particularly for smaller and rural borrowers. Last year, the Reserve Bank conducted a test of a digital infrastructure that facilitates seamless financing in two states.

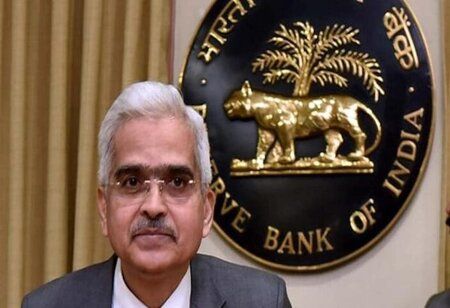

"From now on, we recommend calling it (the platform) the Unified Lending Interface (ULI). This platform enables the seamless and consent-based flow of digital information, including land records from various states, from multiple data service providers to lenders," said RBI Governor Shaktikanta Das at the RBI@90 Global Conference on 'Digital Public Infrastructure and Emerging Technologies'.

He emphasized that the 'new trinity' of JAM-UPI-ULI will be a watershed moment in India's digital infrastructure development.

In his inauguration address, Das stated that the Unified Payments Interface, or UPI, a real-time payment system created in India in April 2016 by the National Payments Corporation of India (NPCI), has played an important role in the expansion of retail digital payments in India.

The NPCI was promoted by banks under the supervision of the Reserve Bank of India. While banks were the founding players on the UPI network, non-bank third-party app developers and the use of QR codes have all contributed to UPI's popularity.

It has subsequently developed as a stable, cost-effective, and portable retail payment system, drawing significant attention throughout the world, according to Das.

He stated that the ULI will speed up credit appraisals, particularly for smaller and rural borrowers. The ULI architecture includes shared and defined APIs that enable a 'plug and play' approach to ensuring digital access to information from various sources.

"This eliminates the complexity of many technical interfaces and allows borrowers to benefit from seamless credit distribution and faster turnaround times without the need for lengthy documentation," he explained.

Das stated that by digitizing access to the customer's financial and non-financial data, which was previously stored in fragmented silos, ULI expects to provide a substantial unmet demand for loans across multiple sectors, notably among agricultural and MSME borrowers.

Technical hurdles can be overcome by implementing common (international) technical standards. Furthermore, Das stated that the governance structure or management framework for long-term sustainability must be completed.

He believes the UPI system has the potential to become a more cost-effective and faster alternative to existing cross-border remittance methods. The Governor stated that small-value personal remittances can be used as a starting point because they are easily executed.