The indirect purchase of Shriram Properties by the company's chairman and managing director, Murali Malayappan (also known as M Murali), has been approved by the market regulator.

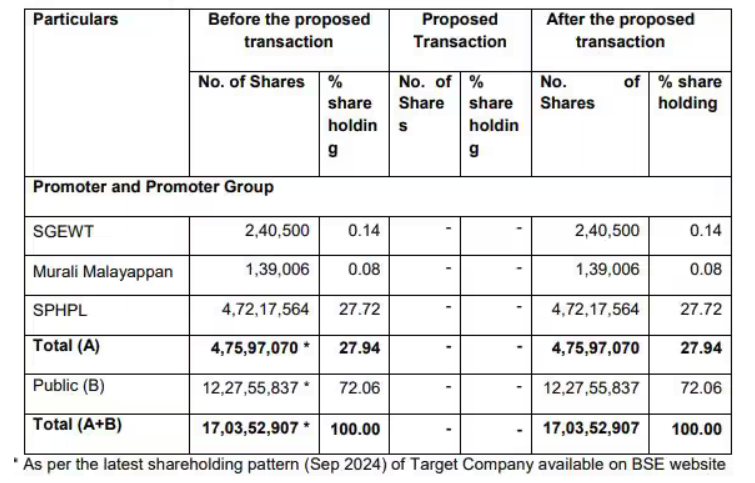

The Securities and Exchange Board of India (SEBI) issued an exemption order on December 2 that states that the indirect acquisition will not result in a change in the target company's (Shriram Properties') ownership. The promoter and promoter group would still own 27.94 percent of the business after the acquisition.

Acquisition through Indirect Means

The majority of the 27.94 percent held by promoters and promoter groups in Shriram Properties is held by Shriram Properties Holdings Pvt Ltd (SPHPL), which owns 27.72 percent of the business.0.08 percent of the business is owned by the CMD.

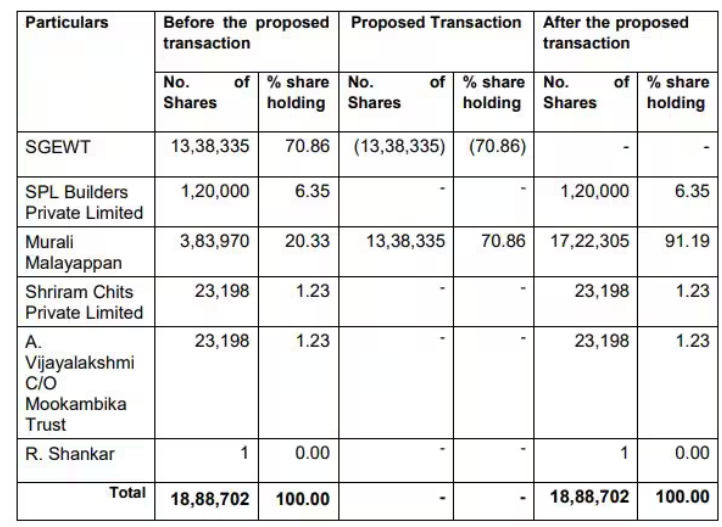

Malayappan has applied for an exemption from the open offer clause under the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, often known as the SAST Regulations, in order to purchase 70.86 percent of SPHPL from Shriram Group Executives Welfare Trust (SGEWT).

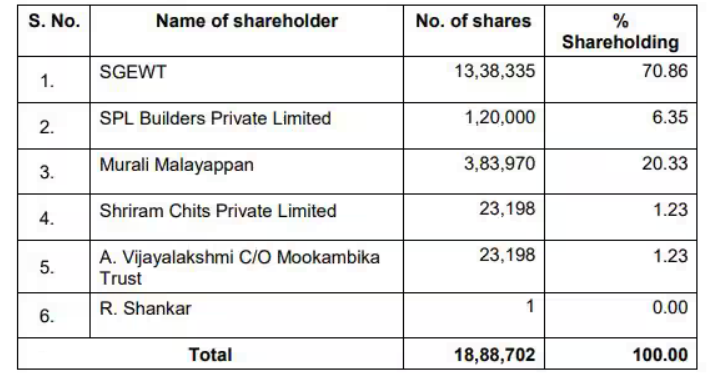

The biggest stakeholder of SPHPL is SGEWT, a promoter group business of Shriram Properties that owns 0.14 percent of the listed company.

At the moment, Malayappan owns 20.33 percent of SPHPL.

Malayappan will own 91.19 percent of SPHPL following the acquisition.

The order from SEBI stated, "The proposed indirect acquisition would not affect or prejudice the interests of the public shareholders of the Target Company in any manner."

It stated, "There will be no change in control of the Target Company pursuant to the proposed acquisition."

In this case, the Takeover Panel had suggested that the putative buyer be given an exemption.

"I, in exercise of the powers conferred upon me under section 19read with section 11(1) and section 11(2)(h) of the SEBI Act,1992 and regulation 11(5) of the Takeover Regulations, 2011, hereby grant exemption to the Proposed Acquirer, viz. Mr. Murali Malayappan, from complying with the requirements of regulations 3(1), 4 and 5(1) of the Takeover Regulations,2011 with respect to the proposed indirect acquisition in the Target Company, viz. Shriram Properties Limited, by way of the proposed transaction as mentioned in Application." Bhatia, a full-time member of SEBI, wrote the order.