With the world economy moving into the year 2026, demographic divergence is emerging as one of the strongest drivers of economic diversification strategies. At one end, there are young states- countries and regions whose working age population is growing like India, Indonesia, some parts of Africa and Southeast Asia. On the other are ageing states, such as Japan, most of Europe, South Korea, China, etc. which are struggling with declining labor supplies and increasing dependency rates. This is the demographic paradigm that is redefining the distribution of capital, industry focus, fiscal incentive and interest rate movements across the world.

Diverging Demographics, Converging Imperatives

Young economies are straining to generate large-scale employment, absorb new entrants, and cash in on the demographic dividend before they run out. Meanwhile, ageing economies are in a mad dash to keep productivity alive, finance their social security systems, and counterbalance the shortage of labour using automation, capital deepening and selective immigration.

Diversification of the economy is no longer a choice to either of the two, but it is a survival tactic.

Key Diversification Pathways (2026)

Financing the Transition: Interest Rate Dynamics

Interest rates play a decisive role in shaping diversification outcomes.

Youthful states generally benefit from moderating or declining interest rates in 2026, enabling:

- Cheaper infrastructure financing

- Expansion of MSME credit

- Growth of housing and consumption demand

Ageing states, however, face a tighter balancing act:

- Higher structural rates to manage inflation and pension liabilities

- Increased reliance on bond markets and private capital

- Demand for stable, yield-generating investments

.jpg)

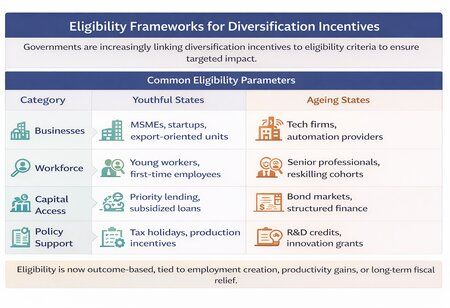

Eligibility Frameworks for Diversification Incentives

Governments are increasingly linking diversification incentives to eligibility criteria to ensure targeted impact.

Common Eligibility Parameters

Eligibility is now outcome-based, tied to employment creation, productivity gains, or long-term fiscal relief.

Also Read: Finance Outlook 2026: Markets, Policy and the Road Ahead

Pros and Cons of Demographic-Led Diversification

Youthful States

Pros

- Large labor pool supports scalable growth

- Strong domestic consumption potential

- Attracts global manufacturing realignment

Cons

- Risk of jobless growth if skilling lags

- Pressure on infrastructure and public finances

- Vulnerability to global capital flow volatility

Ageing States

Pros

- High capital availability and technological depth

- Strong institutions and mature financial markets

- Focus on high-value innovation

Cons

- Rising healthcare and pension burdens

- Shrinking tax base

- Slower consumption growth

Capital Markets: A Bridge Between Demographics

A notable 2026 trend is the capital market linkage between youthful and ageing states. Pension funds, insurers, and sovereign funds from ageing economies are increasingly deploying capital into youthful markets seeking growth, while youthful states depend on this capital to fund diversification.

This interdependence is driving:

- Cross-border infrastructure bonds

- Green finance instruments

- Long-tenure loans aligned to demographic cycles

Interest-rate arbitrage and risk-adjusted returns are becoming central to these flows.

The 2026 Outlook: Complementarity Over Competition

The divide of demographic populations is not a zero-sum game anymore. Young and old states are getting to know that economic complementarity, as opposed to competition, is the most viable way forward. Young economies supply growth impetus and labour profundity, and the mature economies supply capital, technology and institutional knowledge.

The effectiveness of each group diversifying its economy will be defined by policy alignment, interest-rate regimes which are calibrated, as well as designed eligibility frameworks. The success stories that will be written in 2026 will be those that will have turned the demographic realities into strategic benefits, not merely as an economic weapon, but as a mechanism of long-term stability.