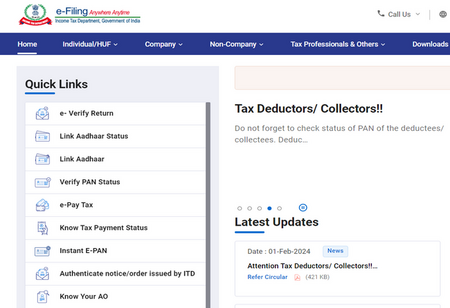

Due to scheduled maintenance, the Income Tax department has announced that its services for taxpayers on the e-filing portal would be unavailable from February 3 to early February 5. Additionally, the administration advised taxpayers to schedule their activities appropriately. The I-T department posted on X that stated, "...taxpayer services on the e-filing portal will be restricted from 2 pm on Saturday (03.02.24) to 6 am on Monday (05.02.24) due to scheduled maintenance activity, involving technical upgradation of the system."

During her reading of the Interim Budget speech on Thursday, Union Finance Minister Nirmala Sitharaman claimed that the new Form 26AS and pre-filing tax returns had made the process of submitting tax returns more straightforward and easy. According to her, this year's average return processing time has dropped from 93 days in 2013–14 to just 10 days.

The significant decrease in income tax return processing times is evidence of the positive effects of technological progress. These developments improve efficiency and simplify administrative processes, which in turn improves the general customer experience.

What is FM Sitharaman's position on income tax rates in the interim budget?

Minister of Finance Sitharaman stated: "Under the new tax scheme, there is now no tax liability for taxpayers with income up to Rs 7 lakh, up from Rs 2.2 lakh in the financial year 2013-14." She did, however, note that neither direct taxes nor indirect taxes were proposed.

"As for tax proposals, in keeping with the convention, I do not propose to make any changes relating to taxation and propose to retain the same tax rates for direct taxes and indirect taxes, including import duties," she stated.

However, Sitharaman stated that the Centre will waive unpaid direct tax claims up to Rs 25,000 for the years 2009–10 and up to Rs 10,000 for the years 2010–11 through 2014–15. "This is expected to benefit about a crore tax-payers," she stated.

"The industry was taken aback by the Hon'ble FM's declaration that there would be no increases to direct and indirect taxes, including import duties, for FY 2024–2025—despite the fact that it was essentially consistent with previous interim budgets. The FM has said unequivocally that her choice followed the Interim Budgets tradition. Although significant tax rate changes were not anticipated in the interim budget of 2024, taxpayers had high expectations that the government will reduce taxes by expanding the scope of Section 80C deductions or introducing a separate deduction for insurance payments. On the other hand, the FM declared that up until March 31, 2025, certain tax breaks for start-ups, investments made by sovereign wealth or pension funds, and tax exemptions on specified IFSC unit incomes will all remain in effect. The FM added that the government's comprehensive plan for pursuing "Viksit Bharat," or progressing India, will be unveiled at the July 2024 budget sessions," said Archit Gupta, Founder and CEO, ClearTax.

The PwC India partner and leader of economic advisory, Ranen Banerjee, continued, "There has been no change on the taxation front, and we will have to wait for the full budget for any changes, with the government sticking to the norm of not making major announcements in an interim budget."